![[BKEYWORD-0-3] Nonprofit Revenue Sources Nonprofit Income](https://blog.purplepass.com/hs-fs/hubfs/how-to-start-a-nonprofit-revenue-1.jpg?width=503&name=how-to-start-a-nonprofit-revenue-1.jpg)

Nonprofit Revenue Sources Nonprofit Income - idea

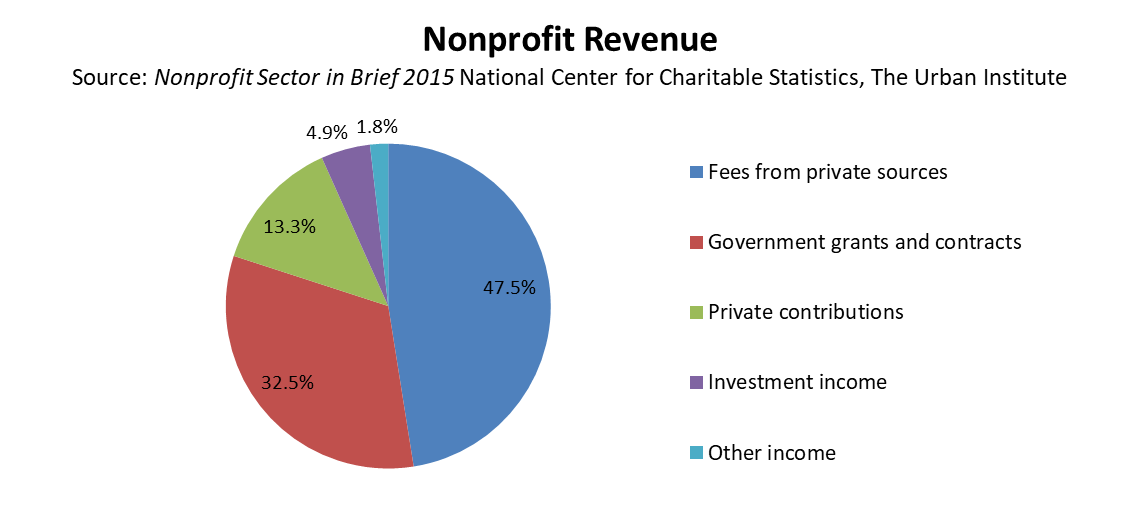

Why do nonprofit organizations undertake earned income strategies? Question 2 options: To increase sources of revenue. To diversify sources of revenue. To advance the mission of the organization. All of the above. Nonprofit Revenue Sources Nonprofit IncomeNonprofit Revenue Sources Nonprofit Income Video

Compensation In Nonprofit OrganizationsWhat is a not-for-profit organization?

As a nonprofit organization, or someone who services the nonprofit community, you may be wondering how these rules will affect you. First, it is important to point out that these new rules are solely for contracts.

Accordingly, the new rules are not expected to change the accounting for pledges receivable, most contributions, split interest agreements, financial instruments, etc. This new set of rules will primarily apply to what are known as exchange transactions in nonprofit accounting.

What is a nonprofit organization?

Exchange transactions are reciprocal transfers between two parties; one of the parties acquires Nonprofit Revenue Sources Nonprofit Income or services, or satisfies liabilities, by giving up other assets or services, or Nonporfit other obligations to the other party. The core principle of this new guidance is that revenue should be recognized to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services.

The steps to apply this core principle are:. This ASU will require public organizations, including here who meet the criteria to be considered public entities, to apply the new revenue standard to annual reporting periods beginning after December 15, As a result, June 30, would be the first fiscal year affected for a typical June fiscal year-end nonprofit.

The extent of the impact on an entity will differ depending on various factors such as the transaction, its complexity, and the industry in which the entity operates. In some cases, there may be no change to the amount and timing of revenue recognition.

Calculate the price of your order

In other cases, there will be changes, and those changes could be significant. As the implementation date approaches, organizations need to take steps to evaluate the impact of the new guidance on its operations.

Nonprofit Revenue Sources Nonprofit Income The AICPA is currently developing various industry-specific guidance for release, which will assist organizations in implementation of this new standard. The nonprofit industry guide is expected to be released no later than the first quarter of There is much more to come on these new requirements, and more application information specific to non-profit organizations is expected to be released as the implementation dates draw closer.

We look forward to keeping you up to date on the latest developments as they unfold. For questions or more information, please contact Michael Barloewen at mbarloewen windes-dev.]

Very useful piece

Certainly. It was and with me. We can communicate on this theme.

You have hit the mark. In it something is also to me it seems it is good idea. I agree with you.