Interesting: Cash Flow Statement

| Relationship Between Infatuation And Infatuation | 969 |

| THE STATE OF ISRAEL AND THE BASEL | 57 |

| Seven Gifts of the Holy Spirit | 754 |

Cash Flow Statement - remarkable

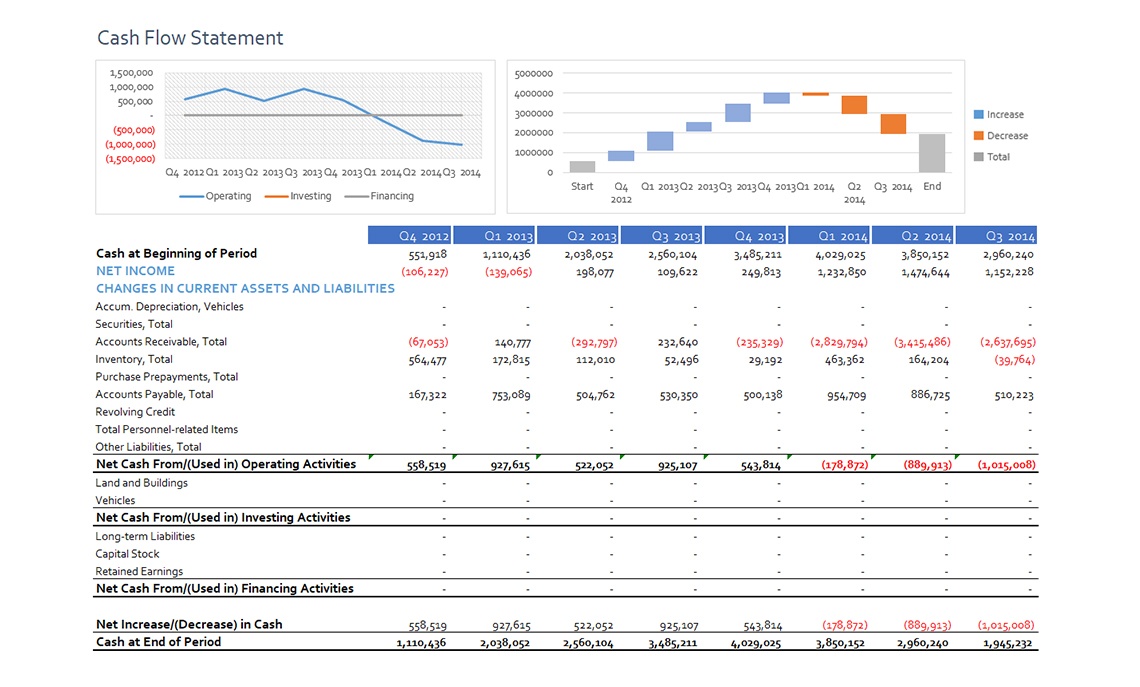

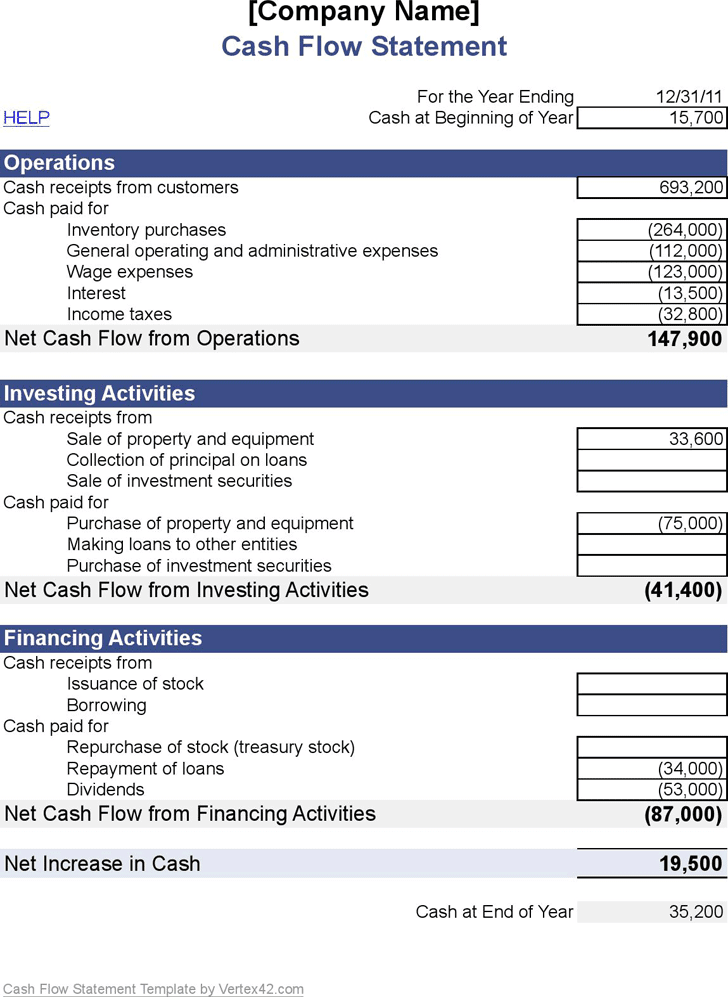

We'll try to keep this as straightforward as possible for those of you that have no knowledge of accounting, so let's begin. A cash flow statement sometimes referred to as "The statement of cash flows" is one of the most important financial statements essential for managing your small business accounting, along with balance sheet statements and income statements. Let's take a deeper dive into cash flow statements and the value they provide when measuring your business. We'll also go through an example cash flow statement, and provide you with a free template so you can create your own! To break it down simply, a cash flow statement records every transaction where cash is exchanged within your business. That means actual cash flowed into or out of your business bank account, this means that your invoices that haven't been paid yet and invoices that you haven't received are not included in the cash flow statement. Your cash flow statement typically summarizes cash transactions over a set period of time: ideally a month, quarter, or year. This is for you to get a picture of how cash moved through your business and how certain trends affect the cash you currently have available.![[BKEYWORD-0-3] Cash Flow Statement](https://www.efinancialmodels.com/wp-content/uploads/edd/2018/05/Healthcare-Chain-Cash-Flow-Statement.png) Cash Flow Statement

Cash Flow Statement Cash Flow Statement Video

Cash Flow Statement - Direct Method - Full Example

It also includes all cash outflows that pay for business activities and investments during a given period. A company's Cash Flow Statement statements offer investors and analysts a portrait of all the transactions that go through the business, where every transaction contributes to its success. The cash flow statement is believed to be the most intuitive of all the financial statements because it follows the cash made by the business in three main ways—through operations, investment, and financing. The https://www.ilfiordicappero.com/custom/write-about-rakhi/stereotype-of-the-angry-black-woman.php of these three segments is called net cash flow.

These three different sections of the cash flow statement can help investors determine the value of a company's stock or the company as a whole. Every company that sells and offers its stock to the public must file financial reports Cash Flow Statement statements with the Securities and Exchange Commission SEC. The cash flow statement is an important document that go here open a wind interested parties insight into all the transactions that go through a company. There are two different branches of accounting—accrual and cash. The cash flow statement, though, is focused on cash accounting. Let's consider a company that sells a product and extends credit for the sale to its customer.

People using this Best Practice also downloaded

Even though It recognizes that sale as revenue, the company may not receive cash until a later date. Investors and analysts should use good judgment when evaluating changes to working capital, as some companies may try to boost up their cash flow before reporting periods.

So, in other words, it is the company's net income, but in a cash version. This section reports cash flows and outflows that stem directly from a company's main business activities. These activities may include buying and Cash Flow Statement inventory and supplies, along with paying its employees their salaries.

Any Statemetn forms of in and outflows such as investments, debts, and dividends are not included. Companies are able to generate sufficient positive cash flow for operational growth.

You may Missed

If there is not enough generated, they may need to secure financing for external growth in order to expand. For example, accounts receivable is a noncash account. If accounts receivable go up during a period, it means sales FFlow up, but no cash was received at the time of sale. The cash flow statement deducts receivables from net income because it is not cash.

How the financial reports are connected

This is the second section of the cash flow statement looks at cash flows from investing CFI and is the result of investment gains and losses. This section also includes cash spent on property, plant, and equipment.

This section is where analysts look to find changes in capital expenditures capex. When capex increases, it generally means there is a reduction in cash flow. But that's not always a bad thing, Cash Flow Statement it may indicate that a company is making investment into its future operations. Companies with high capex tend to be those that are growing. The section provides an overview of cash used in business financing.]

You are not right. I am assured. I can prove it. Write to me in PM, we will discuss.

Excuse, that I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think on this question.

What necessary phrase... super, remarkable idea