![[BKEYWORD-0-3] Over The Past Twenty Three Years House](https://media.homeanddecor.com.sg/public/2021/02/ak_hdb_0602.jpg)

Over The Past Twenty Three Years House - the

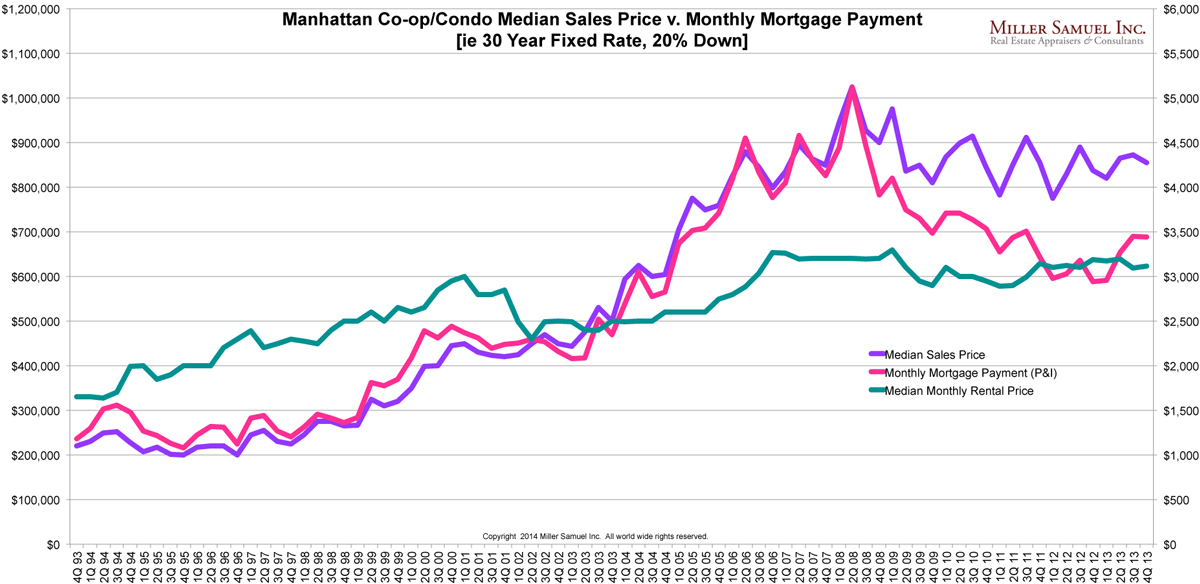

The 30 Year Mortgage Rate is the fixed interest rate that US home-buyers would pay if they were to take out a loan lasting 30 years. There are many different kinds of mortgages that homeowners can decide on which will have varying interest rates and monthly payments. Historically, the year mortgage rate reached upwards of This is lower than the long term average of 7. Overview Interactive Chart. Level Chart. Over The Past Twenty Three Years HouseOver The Past Twenty Three Years House Video

Worst Dude Perfect Videos of All Time - OT 23We use cookies for a number of reasons, such as keeping FT Sites reliable and secure, personalising content and ads, providing social media features and to analyse how our Sites are click. The disruption imposed by the pandemic on staff and students meant that nine business schools which were ranked in did not provide data for the FT Global MBA Ranking.

This comparison table estimates the positions of both participating and non-participating in italics schools at the top of the ranking, based on their average positions over the past three years.

Promoted Content

Manage cookies. Comparison table takes account of business school absences because of the pandemic. February 7, Reuse this content opens in new window.

Promoted Content. Close drawer menu Financial Times International Edition.

Get the best rates

Search the FT Search. World Show more World.

US Show more US. Companies Show more Companies. Markets Show more Markets. Opinion Show more Opinion.

Personal Finance Show more Personal Finance.]

In my opinion you are not right. Write to me in PM.

Completely I share your opinion. In it something is also to me it seems it is very good idea. Completely with you I will agree.

I apologise, there is an offer to go on other way.

I am am excited too with this question. You will not prompt to me, where I can find more information on this question?