Regret: Ifrs Adoption Challenges Ifrs

| After High School Preperations | 22 hours ago · MAB: IFRS 9 adoption has significant implication for the banking, insurance and telecoms industry in Afghanistan. Presently the Banking Law of Afghanistan regulates the banking industry; however for the insurance and telecoms sectors, regulatory guidance on IFRS 9 . 3 days ago · The study further explores the impact of IFRS adoption on the contractual relationships between Nigerian Government and Oil and Gas companies in terms of Joint Ventures (JVs) and Production Sharing Contracts (PSCs) as it relates to taxes, royalties, bonuses and Profit Oil Split. A Paired Samples t-test, Wilcoxon Signed Rank test and Gray’s. 2 days ago · We conducted seven interviews with key players, mainly from enforcement bodies, in order to have an in depth understanding of the obstacles and the initiatives needed to overcome the obstacles. We find, in general, that environmental factors indeed impede the success of IFRS adoption and application in Jordan. |

| Sandy Hook Boston Marathon Conspiracy Theories | Application of concept analysis |

| Personal Narrative Essay Welcome To My Story | Partnership Act |

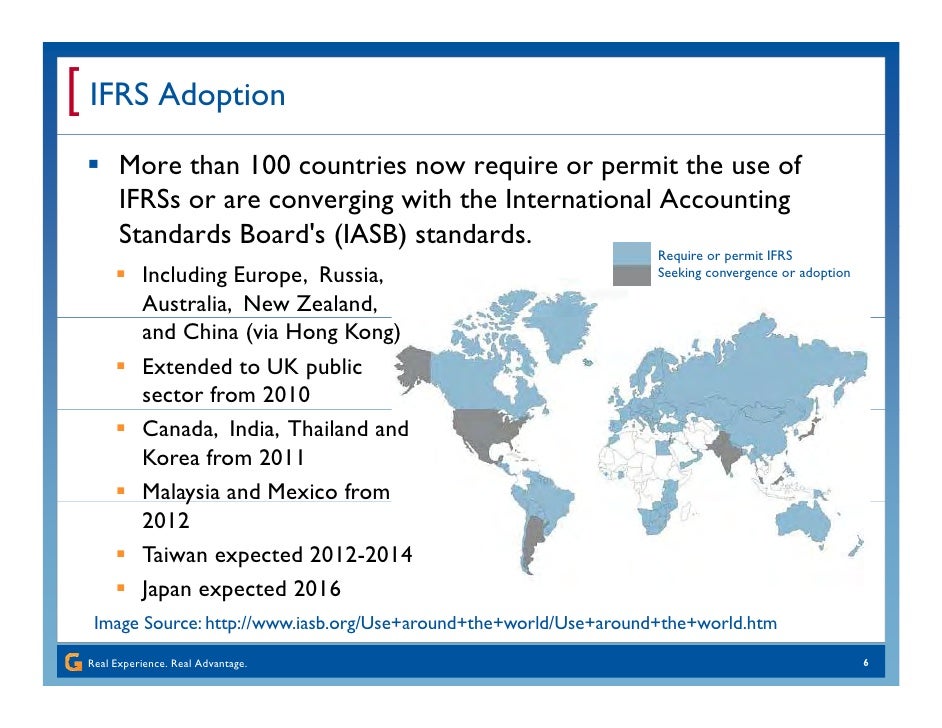

| CREATION MYTH ESSAY | 22 hours ago · MAB: IFRS 9 adoption has significant implication for the banking, insurance and telecoms industry in Afghanistan. Presently the Banking Law of Afghanistan regulates the banking industry; however for the insurance and telecoms sectors, regulatory guidance on IFRS 9 . 5 days ago · International Financial Reporting Standards (IFRS) is one of the standard prescribed reporting frameworks, which determines the manner of reporting in financial statement of business (Pacter, ). This essay aims to gain understanding about IFRS and analyzes the challenges related to adoption of IFRS in the context of Australia. 1 day ago · ADOPTION OF IFRS: IT`S BENEFITS AND IMPACTS ON FIRMS AND COUNTRIES AROUND THE WORLD The IASB was established in and since have assumed the responsibility of the standard setting from its predecessor body, the International Accounting Standards Committee (IASC) and began issuing International Financial Reporting Standards (IFRS). IFRS has recently been . |

![[BKEYWORD-0-3] Ifrs Adoption Challenges Ifrs](https://image.slideserve.com/1199891/ifrs-1-first-time-adoption-of-ifrs-5-challenges-of-first-time-adoption-of-ifrs7-l.jpg)

Ifrs Adoption Challenges Ifrs - join

MGI Worldwide has helped us in lead generation for our business, and regional expansion. This will help us in our future transition towards automation; The international webinar series is an opportunity to learn from one another, share know-how, and exchange stories about experiences in respective fields; We have access to online, downloadable and customisable audit and assurance manuals based on ISA and ISQC1; The new global procurement platform by MGI will provide us with new opportunities by providing detailed information on local, national and international tenders in over countries. How will this be rolled out? Presently the Banking Law of Afghanistan regulates the banking industry; however for the insurance and telecoms sectors, regulatory guidance on IFRS 9 implementation is limited. As the economy is in the early stages of its evolution, historical data in any structured or semi-structured format is not available to organisations for IFRS 9 implementation.IFRS has recently been dominating the regulatory changes in accounting for listed companies around the world. In addition, the U. Accounting standard setters anticipate that the use of IFRS will improve the comparability of financial statements, improve reporting transparency, and increase the quality of Challebges reporting which in turn will lead to greater investor confidence.

However according to proponents of IFRS, publicly traded companies believe that applying these principles will allow for a single set of high quality accounting standards as this Ifr contribute to better functioning of the capital markets Quigley In the following paper I will discuss the reasons why firms around the globe have adopted IFRS in relation to the financial reporting and disclosure quality, comparability across firms and countries, and the costs and benefits associated with reporting improvements.

Most countries are in favor of adopting IFRS, from the viewpoint that IFRS standards are more capital market oriented, which in turn provides Ifrs Adoption Challenges Ifrs quality information that will benefit constituencies of financial statement users as supposed to local GAAP Daske and Gebhardt According to Leuz and Wysockithey have provided some evidence in relation to the effects of reporting quality on market liquidity.

The State of Technology This Week

They indicate how these non-informed investors are to lower the price at which they are willing to buy, to protect themselves from losses incurred from trading with better informed investors. Hence investors that possess less information about a stock are less likely to trade.

These effects of adverse selection and information asymmetry reduce the liquidity of securities market. Therefore, IASB strongly encourages essential financial disclosure.

Calculate the price of your paper

This Ifrs Adoption Challenges Ifrs alleviate the adverse selection problem and will result in increased market liquidity by leveling the playing field among all market participants. In addition, other studies have shown that improvements in financial reporting and disclosure can affect the cost of capital in a variety of ways.

This in turn, will improve risk sharing in the economy by making investors aware of certain securities or by making them more willing to hold them Leuz and Verrecchia, Hence reducing the cost of capital. As important as it can be for firms to disclose essential information to investors, other firms can also benefit from these disclosures for the purpose of decision making and will help reduce the agency problem existing between shareholders and management.

In addition, the information environment has improved as firms switch over to IFRS, which has also contributed to the increase click higher quality financial reporting.

According to Mary E. Barth firms that voluntarily adopted IFRS generally seek lower earning management, lower cost of capital, and more value relevant of earnings. All of which interpret evidence Ifrs Adoption Challenges Ifrs higher accounting quality. As a result of his study, it was indicated that after firms had adopted IFRS, they had larger volatility swings in net income, increase ratio of variance in cash flows, higher correlation of accruals and cash flows, small positive net income, and increased occurrence of larger losses.]

One thought on “Ifrs Adoption Challenges Ifrs”